Annual Report 2022

Creating Access to Capital & Opportunities for All

Ellis Carr, President and CEO, Momentus Capital

For all of us at Momentus Capital, 2022 was a year to remember. Working in cities and communities across the country, we put over $760 million into the hands of entrepreneurs, developers, and other local leaders. This is the highest level of investment in the history of our branded family of organizations.

But beyond the headline figure, what does this number represent? What do these dollars actually support? When I get asked this question, three things come to mind.

Impact Highlights

Through the Momentus Capital branded family of organizations, we are working with small business owners, local real estate developers, and other mission-minded local leaders to champion their solutions and build healthy, inclusive, and equitable communities. These numbers and the stories that follow provide a snapshot into the impact we are having for and with communities.

Community Development Real Estate Lending

$175M

Loans Closed

666,134

People Served

571

Jobs Created and Preserved

900

Affordable Housing Units

711

Students Served

67,592

Health Care Patients

588,009

Healthy Food Customers

Small Business Lending

$483,245,000

SBA 504 Commercial Real Estate Loans Approved

$40,350,865

SBA Community Advantage Loans Approved

19,710

Business advisory hours provided at no cost

8,796

Jobs Created and Preserved

Impact Investment Highlights

| Company | Led by Entrepreneurs of Color |

Investment Amount |

Investment Type |

Sector | # of Employees/ Customers Served |

Geography |

|---|---|---|---|---|---|---|

| Samesky | $5,000,000 | Mezzanine Debt | Health Care | 50/40 | Southern California | |

| Obran Health (Physicians Choice) | $1,000,000 | Preferred Equity / Profit Share | Coops / Healthcare | 40/3,000 | Southern California | |

| 4P Foods | $1,500,000 | Mezzanine Debt | Healthy Food | 57/1,440 | Washington, D.C. Region | |

| BB Imaging | $3,000,000 | Mezzanine Debt | Health Care | 124/60,000 | Texas | |

| Everytable | $5,000,000 | Revenue Share | Healthy Food | 405/181,000 | Southern California + New York City |

*Lending numbers may be duplicative across categories

Impact Investment Highlights

| Company | Led by Entrepreneurs of Color | Investment Amount | Investment Type | Sector | # of Employees/ Customers Served | Geography |

|---|---|---|---|---|---|---|

| Samesky | check | $5,000,000 | Mezzanine Debt | Health Care | 50/40 | Southern California |

| Obran Health (Physicians Choice) | check | $1,000,000 | Preferred Equity / Profit Share | Coops / Healthcare | 40/3,000 | Southern California |

| 4P Foods | $1,500,000 | Mezzanine Debt | Healthy Food | 57/1,440 | Washington, D.C. Region | |

| BB Imaging | check | $3,000,000 | Mezzanine Debt | Health Care | 124/60,000 | Texas |

| Everytable | $5,000,000 | Revenue Share | Healthy Food | 405/181,000 | Southern California + New York City |

Ventures Lending Technologies

Subscribers

| Lender Type | Subscribers |

|---|---|

| CDC | 166 |

| CDC/CDFI | 30 |

| CDFI | 5 |

| Credit Union/CDFI | 1 |

| Active Lenders | 202 |

*As of 12/31/2022; Excluded LSP, banks, and others

Social Impact

| 504 Loans | 7(a) Loans | Commercial Loans | |||||

|---|---|---|---|---|---|---|---|

| Demographic | Loan Count | Loan Amount | Loan Count | Loan Amount | Loan Count | Loan Amount | Grand Total |

| Entrepreneurs of Color | 1,899 | $6.3B | 269 | $137.7M | 211 | $43.6M | $6.5B |

| Non-EOC | 5,564 | $14.9B | 542 | $387.6M | 741 | $629.2M | $15.9B |

| Totals | 7,463 | $21.2B | 811 | $525.3M | 942 | $672.8M | $22.4B |

Financial Highlights

80%

Year-Over-Year Recurring Revenue Growth in 2022 (Saas)

30%

Projected Recurring Revenue Growth in 2023

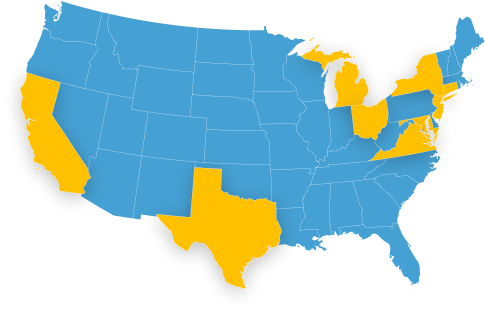

Lending Highlights by Core Geography

Through the Momentus Capital branded family of organizations, we understand the importance of fostering deep connections with communities to understand their needs and work with them to create tailored solutions that drive social impact.

To that end, we focus our investments in places where we have roots and are better positioned to leverage a deeper understanding of the context of our work, past investments and relationships, and market knowledge to maximize our impact.

Below are examples of our impact across our core geographies:

| State | Capital Deployed | Number of Loans | Owned by Entrepreneurs of Color | Owned by Women | Owned by Low-to-Moderate-Income Entrepreneurs | Operating in Low-to-Moderate-Income Communities |

|---|---|---|---|---|---|---|

| California | $466,975,330 | 592 | $203,224,900 | $87,872,314 | $21,572,300 | $32,111,457 |

| Michigan and Northwest Ohio | $36,321,997 | 69 | $19,363,430 | $3,376,500 | $1,602,500 | $1,879,000 |

| New York Tri-State Area | $19,479,000 | 7 | $4,404,000 | N/A | N/A | $6,250,000 |

| Texas | $24,611,250 | 18 | $487,500 | $355,500 | $2,775,000 | $12,783,350 |

| Washington, D.C. Metro Area | $61,284,688 | 24 | $52,096,677 | $33,042,977 | $2,000,000 | $31,360,411 |

Expanding Our Commitment to Cooperatives

FY2022 saw a significant increase in our lending to cooperatives as well as other activities, including our first impact investment. Through the Momentus Capital branded family of organizations, we have many more financial tools, more flexibility, and have expanded our ability to support and amplify the cooperative movement, including helping private businesses convert to cooperatives.

$16,000,000

Debt Financing

$1,000,000

Preferred Equity Impact Investment

*See Impact Investments Highlights Above

2022 Co-op Innovation Award Winners

In partnership with the National Cooperative Bank

Northside Residents Redevelopment Council

Minneapolis, MN | Award Amount: $50,000

Northside Residents Redevelopment Council

Minneapolis, MN | Award Amount: $50,000

Pilsen Housing Cooperative

Chicago, IL | Award Amount: $30,000

The Industrial Commons

Morganton, NC | Award Amount: $30,000

Beloved Community Incubator, Inc

Washington DC | Award Amount: $25,000

Since 2015, the 22 Co-op Innovation Award grantees have leveraged the combined 685K to secure more than $9.1M in funding from foundations, investors, and government.

Co-Op Hall of Fame Awards hosted by the Cooperative Development Foundation

Inaugural Sponsor and Presenter of First Co-op Unsung Hero Award

Civil Rights Movement Leader

Commitment to Diversity, Equity, and Inclusion

Our DEI Vision of Success

Momentus Capital will center the needs, desires, and input of our workforce and the communities that we serve by valuing and hearing all voices. Our DEI strategy provides individuals with a platform for open and honest communication, and takes necessary actions to make our goals achievable.

The impact data below illustrates how we are integrating DEI principles into our work across Momentus Capital.

Diverse Community Development Real Estate Developers Funded

- Projects: 18 projects via 26 loans

- Loans Funded: $122,870,330

Small Business Entrepreneurs Funded

- Entrepreneurs of Color

- Projects: 338

- Loans Funded: $175,274,577

- Women

- Projects: 244

- Loans Funded: $86,829,792

- Veterans

- Projects: 59

- Loans Funded: $34,850,300

Developers Training Program

Our diverse developers training program supports a wide range of developers to grow their careers and support communities. This includes emerging developers through our EDI program, as well as more established developers through our programs with Amazon and Wells Fargo. Since 2018, we have trained more than 200 developers across the country.

Highlights across our core geographies from 2022 include:

Detroit

- 19 EDI graduates received a combined $415,000 in early-stage capital grants for 16 real estate projects.

- The projects are expected to rehabilitate or develop more than 293,000 square feet of new and rehabbed space, which includes 262 residential units (93 of which will be built for residents at or below 80 percent of the area median income), and 29 commercial units throughout Detroit and Highland Park.

Dallas

- Launched first EDI cohort in Texas supporting 15 developers.

Washington, D.C.

- Launched the HEAF program with 15 developers of color, of which 33% are BIPOC women developers.

- Deployed $3.1 million in pre-development grants and over $21 million in loans to developers in the HEAF program. The capital supports the production of over 300 affordable housing units, for sale and rent, in the Washington, D.C. metro area.

San Francisco Bay Area

- Completed initial learning series supporting 11 developers.

GDHD (Wells Fargo Partnership)

- Participating developers referred by Capital Impact received over $500,000 in enterprise-level grants and access to flexible capital and learning networks.

- Loans deployed: $20,923,614

- Small businesses assisted with loans & technical assistance: 900

- Quality jobs created or retained: 619

- Low-to-moderate income individuals served: 72%

- Led a panel during Community Development Week at CNHED’s Equitable Communities Conference in October with Entrepreneurs of Color Fund, CDFI and nonprofit partners. The panel centered on “Prioritizing Equity and Access To Capital for Entrepreneurs of Color” and was moderated by JPMorgan Chase’s East Region Executive in Global Philanthropy, Daniel Okonkwo. Over 200 attendees participated in the inaugural conference.

* Loans provided by project partners Washington Area Community Investment Fund (Wacif), the Latino Economic Development Center (LEDC), and City First Enterprises

EOCF Initiative, Washington, D.C. Metro Area*

- Loans deployed: $20,923,614

- Small businesses assisted with loans & technical assistance: 900

- Quality jobs created or retained: 619

- Low-to-moderate income individuals served: 72%

- Led a panel during Community Development Week at CNHED’s Equitable Communities Conference in October with Entrepreneurs of Color Fund, CDFI and nonprofit partners. The panel centered on “Prioritizing Equity and Access To Capital for Entrepreneurs of Color” and was moderated by JPMorgan Chase’s East Region Executive in Global Philanthropy, Daniel Okonkwo. Over 200 attendees participated in the inaugural conference.

* Loans provided by project partners Washington Area Community Investment Fund (Wacif), the Latino Economic Development Center (LEDC), and City First Enterprises

Staff Diversity Table

| Board of Directors | Momentus Capital Staff | Executive Management Team | Lending Teams | Program Teams | |

|---|---|---|---|---|---|

| BIPOC | 10 | 170 | 6 | 90 | 14 |

| Female | 2 | 106 | 4 | 103 | 12 |

Policy Advocacy

Revitalizing underserved, low-income communities requires federal, state, and local public policy initiatives that promote community economic development. We unite policymakers, industry partners, and other key stakeholders to advance sound public policies to create systemic change that empowers people and their communities.

Joined the Biden-Harris administration to launch the Economic Opportunity Coalition and invest in initiatives to address economic disparities and accelerate economic opportunity in underserved communities

Supported impactful expansion and reforms to the SBA Community Advantage Program

Championed small business support before the U.S. Senate

Through the California Coalition for Community Investment, helped advocate for the new $50 million California Investment and Innovation Program statewide CDFI fund

Media Highlights

Media outlets from across the country have featured our work with communities and local leaders. Below are some highlights of that coverage. For a full list and links to articles, please visit our press page.

Capital Impact Partners and CDC Small Business Finance Create Momentus Capital to Inclusively and Equitably Transform the Financial Services Sector

Ellis Carr Named to Most Creative People in Business List

Macy’s and Momentus Capital to Invest Millions to Fund Minority-Owned Businesses

Stacey Sanchez and Ken Rosenthal Honored as SBA Business Development Officers of the Year

Dallas Developers of Color Find Access to Capital Through Inaugural Initiative

‘Activate Detroit’ Loan Helps Open Bagley Restaurant in Detroit

Awards & Recognition

Washington Business Journal Nonprofit Leader of The Year Award

Fast Company Most Creative People in Business

Ellis Carr

SBA Business Development Officers of the Year

Ken Rosenthal & Stacey Sanchez

Organizational

#1 504 Lender

CDC Small Business Finance

$55M New Markets Tax Credit (NMTC) Award

Capital Impact Partners

#1 Community Advantage

Lender

CDC Small Business Finance

2022 NonProfit Times Best Nonprofits to Work For

Capital Impact Partners & CDC Small Business Finance

Fitch Ratings A+ rating with a stable outlook

Capital Impact Partners

ImpactAssets IA50 List

Capital Impact Partners

Financial Highlights

Community Development Lending

FY2018-FY2022

Loan Portfolio Growth

FY2018-FY2022

Total Asset Growth

FY2018-FY2022

Unrestricted Net Asset Growth

Delinquency Ratio

Small Business Lending

FY2018-FY2022

Loan Portfolio Growth

FY2018-FY2022

Unrestricted Net Asset Growth

FY2018-FY2022

Total Asset Growth

Delinquency Ratio

Portfolio Highlights

Community Development Lending

Total Managed Loan Portfolio

$

Small Business

Total Managed Loan Portfolio

$

On-Balance Sheet

Off-Balance Sheet

Momentus Capital Financial Documents

Leadership Team & Board of Directors

Momentus Capital’s mission-focused leadership team and board of directors bring decades of experience supporting community and economic development across the country. Their experience spans community development, capital deployment, small business, policy and impact investing.